Pay Attention to the Insights of Co-Founders

If you’ve ever applied to an accelerator or approached (many) investors for funding, one of the most important points they check, especially in the case of investors, is team.

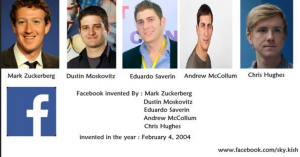

Above all, they want to know about the co-founders, and truth be told, most investors shy away from a startup with a solitary founder, the stated reason most often being that you should be able to find at least one person who shares your vision or passion and is willing to throw in with you. It’s also difficult to operate in a vacuum: much easier if you have that other person off whom to bounce ideas, and to keep you in check, if need be.

Chris Hughes wrote a must-read editorial in the New York Times (It’s Time to Break Up Facebook) and the Facebook co-founder, who sold off his stock in 2012 and no longer invests in social media, presented both the pros and cons of breaking up Facebook, and made some suggestions for doing so, as well as some dire warnings if it isn’t done soon. Attention must be paid, not only due to the fact that the company has lost control of the platform, but also because it doesn’t seem to matter to Zuckerberg at all: despite his many promises, apologies and assurances, he either does not, will not, or cannot control the platform – unless there are factors involved that are part of his agenda, as we see with the selective deplatforming that has been going on. As Hughes pointed out, “The most extreme example of Facebook manipulating speech happened in Myanmar in late 2017. Mark said in a Vox interview that he personally made the decision to delete the private messages of Facebook users who were encouraging genocide there…Mark made a call: “We stop those messages from going through.” Most people would agree with his decision, but it’s deeply troubling that he made it with no accountability to any independent authority or government. Facebook could, in theory, delete en masse the messages of Americans, too, if its leadership decided it didn’t like them.”

Hughes also mentioned that practically from the start of the company, Zuckerberg was about domination, “with no hint of irony or humility.”

With the recent and upcoming IPOs, we’ll no doubt see the ‘Web Trust’ expanding, and by that we mean single companies that dominate verticals, as we’ve witnessed with Google, Facebook and Amazon. The Lyft and Uber IPOs might have so-called underperformed, but think about all that data they’ve collected and continue to collect (Uber’s First Day as a Public Company Didn’t Go So Well), and Airbnb is also in the IPO queue. Founded in 2008, the accommodations rental platform now no doubt manages more rooms than any single hotel chain in the world, that long pre-dated the service. Same with WeWork (founded 2010, now the We Company), no doubt one of the biggest real estate companies in the world, with a valuation of roughly $47B and managing some 10,000,000 square feet of office space as of Q1 2019, according to Wikipedia.

In a few short years, nascent companies eclipse entire verticals.

Most founders have a co-founder or two, but truth be told, only one running the company. Think Uber and Travis Kalanick, who did have a co-founder (Garrett Camp) and Adam Neumann (WeWork – OK, the We Company) co-founder Miguel McKelvey, whose name is not nearly as recognizable as Neumann’s.

As witnessed by Hughes’s op-ed, cofounders do tend to have insights into the CEO’s drivers and long-term vision.

Jeff Bezos never did have a co-founder, so we can’t know with any certainty what his long-term vision was.

But he did name the company Amazon.

“Subject Matter Experts”

As an aside, investors also tend to focus on whether or not the founder or someone on the founding team is a subject matter expert. Question: in how many bookstores or chains was Jeff Bezos employed before he founded Amazon? Did Kalanick ever work in the taxi or limousine industry? Technology has changed the game. Bezos doesn’t sell just books anymore. He sells groceries, clothing, the list goes on, and continues to consume industry verticals: he now owns the Washington Post; Whole Foods; AWS is the fastest growing SaaS business in history; there’s Amazon Prime TV, health care and insurance, and Blue Origin. Bezos doesn’t and never needed to be an expert in any of these industries: he just needed to know technology and what was and would/could be possible.

We know that empires and companies come and go, and that Facebook may not be the platform du jour in a few years. On the other hand, Facebook also own Whatsapp and Instagram, and who know what they’ll devour next. Ditto the rest of the Web Trust: they’re not one-trick ponies: they’re hydras.

We can’t say with any certainty, either, that breaking up Facebook or any of the Web Trust companies is the answer. Given the data that they hold, they may become even more powerful. But the Web Trust, which is expanding, definitely needs to be reigned in. After all, unlike the majority of our elected representatives, we do know technology and the players, and that if given much more of a rope and leeway, what is and can be possible in not too long a time. Onward and forward.